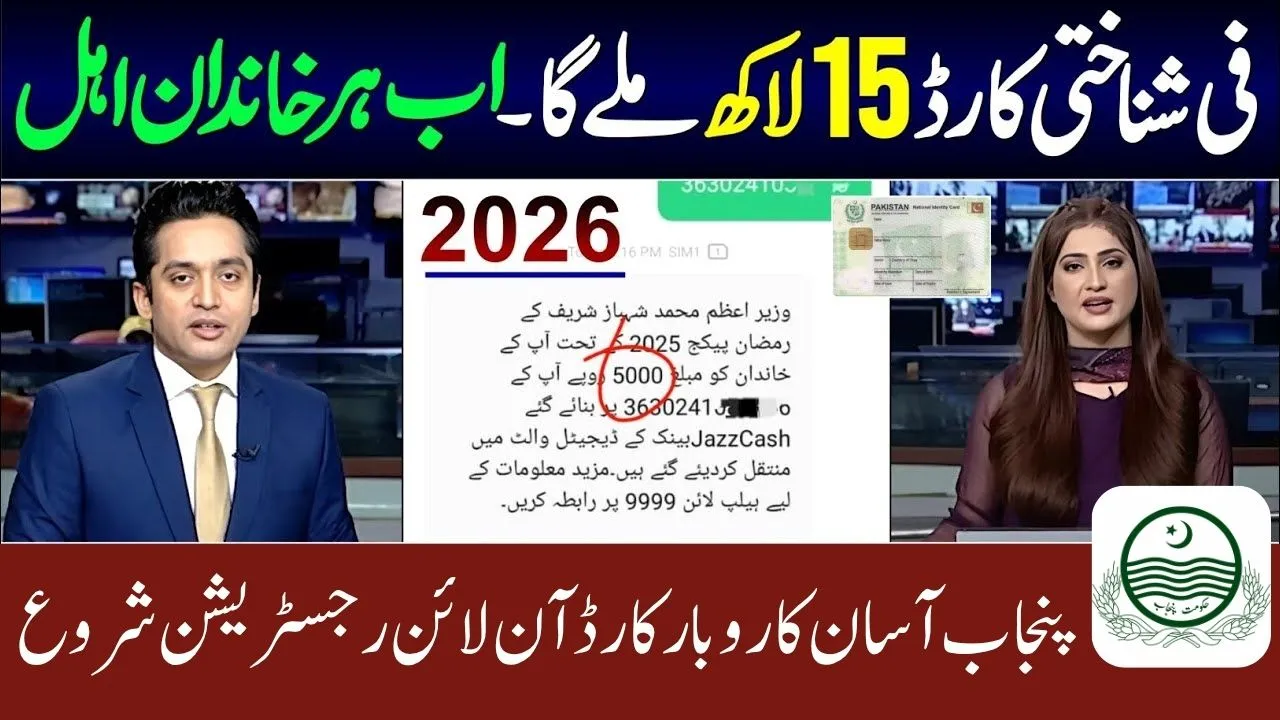

Big News: CM Maryam Nawaz Loan Scheme 2026 | Punjab Asaan Karobar Card Online Registration Guide

Punjab government under the leadership of Chief Minister Maryam Nawaz Sharif has officially launched the Maryam Nawaz Loan Scheme 2026. This program, also known as the Punjab Asaan Karobar Card, is designed to support small businesses, startups, freelancers, and jobless youth in Punjab who want to start or expand their work.

The scheme offers interest-free and easy installment loans through a digital system where beneficiaries will receive a Karobar Card for convenient withdrawals and transactions. If you are confused about how to apply, register online, and get this card, don’t worry. This guide will explain the full registration process, eligibility, loan details, and the latest updates for 2026.

By the end of this article, you’ll know exactly how to apply for the Punjab Asaan Karobar Card without confusion, so keep reading carefully.

What is the Punjab Asaan Karobar Card?

Punjab Asaan Karobar Card is a digital loan card issued by the Punjab government to eligible applicants of the Maryam Nawaz Loan Scheme. Instead of going through long paperwork or traditional bank loan procedures, beneficiaries will directly get funds through this card.

This initiative is designed to:

- Provide easy access to credit for small businesses.

- Reduce dependency on private moneylenders.

- Encourage youth entrepreneurship in Punjab.

- Support women, freelancers, and home-based workers.

Quick Facts: Punjab Asaan Karobar Card 2026

| Feature | Details |

| Scheme Name | Maryam Nawaz Loan Scheme 2026 |

| Card Name | Punjab Asaan Karobar Card |

| Loan Amount | Rs 1 lakh to Rs 10 lakh (different slabs) |

| Interest Rate | 0% (Interest-Free) |

| Repayment | Easy monthly installments |

| Eligibility | Residents of Punjab, CNIC holders, small business owners, unemployed youth, freelancers |

| Application Mode | Online Registration |

| Card Usage | ATM Withdrawals, Online Transfers, POS Machines |

| Launch Year | 2026 |

Loan Amounts and Repayment Details

The Punjab Asaan Karobar Card will provide different categories of loans depending on the applicant’s need.

| Category | Loan Amount | Repayment Terms |

| Starter Business | Rs. 50,000 – Rs. 100,000 | Easy monthly installments |

| Small Traders | Rs. 100,000 – Rs. 300,000 | 1–3 years repayment plan |

| Medium Enterprises | Rs. 300,000 – Rs. 500,000 | Flexible repayment with grace period |

All loans will be interest-free, and the government will cover administrative charges.

Who Can Apply for Punjab Asaan Karobar Card?

Eligibility is kept simple so that maximum families can benefit. Applicants must:

- Be a resident of Punjab.

- Have a valid CNIC.

- Be between 18 to 45 years of age.

- Have a small business idea, existing shop, or trade.

- Women, widows, and differently-abled persons will get special priority.

Step-by-Step Guide: How to Apply for Punjab Asaan Karobar Card Online

Step 1: Visit Official Portal

Go to the official Punjab government loan portal (link will be announced officially with registration opening).

Step 2: Create Profile

- Enter CNIC number.

- Provide basic details like name, father’s name, mobile number, and address.

- Upload scanned CNIC copy.

Step 3: Business Information

- Mention whether you are starting a new business or expanding an existing one.

- Enter estimated cost and loan amount required.

Step 4: Submit Application

- Review all details carefully.

- Submit application online and note your tracking ID.

Step 5: Verification

- NADRA and Punjab government officials will verify your details.

- If approved, your loan amount will be sanctioned.

Step 6: Get Punjab Asaan Karobar Card

- Once approved, you’ll receive the Karobar Card through the nearest bank branch.

- Use it like a debit card for withdrawals, payments, and business expenses.

Required Documents for Registration

- Copy of CNIC (front and back).

- Passport-size photo.

- Proof of residence (utility bill or domicile).

- Business plan (for loans above Rs 2 lakh).

- Bank account details.

How the Loan Will Be Disbursed

Funds will not be handed in cash directly. Instead, they will be transferred digitally into your Punjab Asaan Karobar Card. This ensures transparency, prevents misuse, and allows you to withdraw money whenever needed through ATMs or POS machines.

Objectives of the Asaan Karobar Loan Scheme

The Punjab government has set clear goals with this scheme:

- Reduce unemployment by creating new small businesses.

- Provide financial empowerment to women and youth.

- Promote self-reliance instead of dependence on aid programs.

- Strengthen local businesses and encourage entrepreneurship.

- Support skilled labor and freelancers with financial backing.

Frequently Faced Problems and Their Solutions

| Problem | Solution |

| Application not approved | Check eligibility, re-submit complete documents |

| Delay in loan disbursement | Contact partner bank branch for updates |

| No internet for online registration | Use e-khidmat centers in your district |

| Women facing registration issues | Special help desks will be set up for female applicants |

Latest Update for 2026 Applicants

According to Punjab government announcements, online registration will officially open in the first quarter of 2026. Applicants are advised to keep their CNICs, documents, and bank accounts ready in advance to avoid last-minute delays.

Benefits of the Maryam Nawaz Loan Scheme

This scheme is more than just money. It’s about creating long-term opportunities:

- No interest or hidden charges.

- Encouragement for youth entrepreneurs to take business risks.

- Empowerment of women with independent businesses.

- Reduced poverty through self-reliance instead of charity.

- Promotion of digital economy via card-based system.

How This Scheme is Different from Previous Loan Programs

In the past, many loan schemes failed because of complicated paperwork and lack of follow-up. The Punjab Asaan Karobar Card is different because:

- Registration is digital and transparent.

- Loans are interest-free instead of low-interest.

- Special categories for women, widows, and disabled citizens.

- Direct monitoring by the Punjab government to ensure fairness.

FAQs about Maryam Nawaz Loan Scheme 2026

Q1: Is this scheme available only for Punjab residents?

Yes, currently it is limited to Punjab only.

Q2: Do I need collateral for this loan?

No, the loans are collateral-free.

Q3: Can women apply separately?

Yes, women will get special preference in loan approval.

Q4: What happens if someone fails to repay?

The government has set flexible installments, but failure to repay may affect your credit record and future eligibility.

Q5: Can freelancers or online workers apply?

Yes, freelancers are eligible and can use the loan for setting up digital businesses.

Conclusion

The Maryam Nawaz Loan Scheme 2026 (Punjab Asaan Karobar Card) is a golden chance for youth, women, and small traders who want to start or grow their businesses but lack financial resources. By providing interest-free loans and a digital card system, the government aims to reduce unemployment, support women empowerment, and boost local entrepreneurship.

If you’re serious about starting your own business or expanding your setup, this is the right time to prepare your documents and apply as soon as registrations open.